Ruth Lipscomb, a wealthy former Microsoft employee, is putting her full effort toward getting Washington state to increase her own taxes.

“I feel that I am not paying my fair share right now,” Lipscomb says. “I know the taxes I pay to the state and local government are nowhere near what they should be.”

Lipscomb’s not the only rich supporter of Initiative 1077, which would add an income tax for the wealthiest of Washington residents, while reducing property taxes and Business and Occupation taxes. One of the biggest boosters for the initiative is Bill Gates Sr. — dad of the second richest man in America.

Very wealthy in his own right, Bill Gates Sr. has long been a champion of the estate tax. Now, he says the time for him to be taxed more — with an income tax — has come.

“Those who are of such high income, they won’t feel it,” says Richard Schrock, former director of the state Department of Commerce. “It doesn’t matter to them.” Schrock fought the proposed corporate income tax in 1975 and vows to fight this new iteration.

Erma Turner, owner of Erma’s Clip & Curl in Cle Elum, is not nearly as wealthy as Gates and Lipscomb. She’s the type of person I-1077 will be marketed toward. (“Help put middle class tax relief on the ballot,” the Yes on 1077 Website says.)

Because of the reduction in property tax, she’d save money if 1077 passes. But she’s against it. “I don’t trust the government over there,” she says about Olympia. It may start with leveling an income tax against the rich, but she worries it’s a leap down a slippery slope toward income taxes for everybody.

Instead of income level or self-interest, the division between supporters and opponents of an income tax is largely philosophical. Both supporters and opponents claim their position is a matter of fairness.

“It would put a special tax on a certain class of taxpayers, who also happen to be a source of investment in the state in terms of job creation,” Schrock says.

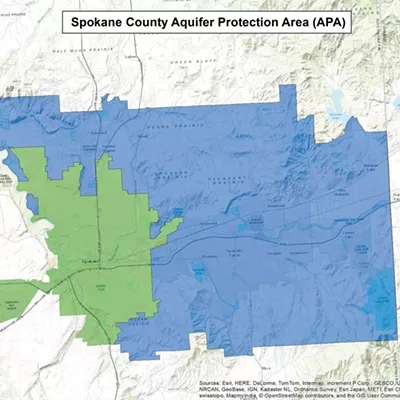

The percentage of income that groups of Washingtonians pay in state and local taxes currently and how how much they'd pay after Initiative 1077. [Source: The Institute of Taxation and Public Policy]

Supporters, obviously, have a different view. “Washington state ranks dead last in terms of basic fairness,” says Yes on 1077 spokesman Sandeep Kaushik. “We have the most regressive tax code of any of the 50 states.”

“Regressive” means the tax system — especially the sales tax — takes a bigger percentage of income from the poor than the rich.

For the past seven decades, Washington organizers have been trying to fix this inequality with an income tax. (Washington is one of only seven states without one.) Voters have meanwhile rejected the notion four separate times. Last year, Senate Majority Leader Lisa Brown (D- Spokane) suggested replacing a bit of the sales tax with an income tax, but dropped the proposal for legislative timing reasons.

But 1077 may end differently. In a KING-5 poll, 66 percent of sampled Washingtonians said they support the 1077 proposal. Brown certainly supports it.

“I think the really important part of this is that most taxpayers would actually pay less than they pay under the current system,” Brown says. Brown pooh-poohs notions that the Legislature would eventually increase the breadth of this income tax.

The details of the latest proposal: Singles making more than $200,000 or couples making more than $400,000 would pay a 5 percent income tax. Singles making more than $500,000 or couples whose income tops $1 million would pay a 9 percent income tax. The 5 percent only applies to the extra income above the $200,000 or $400,000. (In other words, if you’re single and you make $200,001, you’ll only be taxed on that $1.)

The state would net $1 billion, all of it earmarked for education or health care.

At the same time, the initiative would lower state property tax by 20 percent (the state portion is about 4 percent of total property tax) and increase the number of businesses exempt from the Business and Occupation tax. If 1077 goes into effect, supporters say, about 80 percent of all the taxpaying businesses in Washington would be immune from the B&O tax.

“Come November, if voters understand what the elements of 1077 are, we’ll be successful at the ballot,” Kaushik says. There’s where those rich people who want to be taxed more come in.

Along with unions and health care and education advocates, Kaushik says, “quite a few wealthy individuals” will help contribute to the cause.

“I would normally say, ‘Income tax, no effin’ way,” says anti-tax-initiative maestro Tim Eyman. “Voters would never go for something like that. … But we’ve never seen a campaign like this, where you have access to an unlimited supply of money.” Tapping pots of money, says Eyman, doesn’t take much effort for supporters of 1077. “That’s a speed-dial phone call for Bill Gates Sr.”